- CORPORATE

- MODULES

- Mobile Applications for Guests

- Mobile Management System

- Online Rezervation

- PAY TV Integration

- Personnel Attendance Control System

- Pos System

- Sales and Marketing Monitoring

- Technical Service Management

- Timesharing Management

- Banquette Management

- Call Center & Sales CRM Integration

- Call Management System

- Channel Manager

- Crm + Kiosk System

- ETS Accounting Management System

- ETS Personnel and Payroll System

- ETS Procurement Method

- Front Office Management

- Health, Sports and SPA Management

- HR Performance Management

- ID and Passport Reading Software

- Integration of Guest Comment Websites

- Inventory and Cost Analysis Program

- Inventory and Depriciation Monitoring

- Invoice Management

- iSafe Internet Security and Logging

- Loyalty Management

- Call Center & Sales CRM Integration

- ElektraWEB

- REFERENCES

- SUPPORT

- Buy Service

ETS Accounting Management General Characteristics

A comprehensive accounting management program specified for the needs of hotels. Also includes all the necessary modules for administrative processes such as purchasing, fixture, personnel, stock and sales modules apart from bookkeeping and general accounting. Modules can be added according to necessity because of its modular design.

– Track income and expenses according to project, expense centre and product.

– Prepares a cash flow plan at the selected dates according to possible payments and collection information.

– Due payment and collection is remembered automatically.

– Displays TERMS and DEBT PERCENTAGE on Bank Statements.

– Controls credit limits on Checking Accounts.

– Creates Deficit Analysis and Warehouse Cost Analyses according to stocktaking.

– All screens have been authorised by user .Also with the detailed LOG system you can monitor who did a process on any computer

– As you can calculate a balance by process and special code groups, you can also calculate balance by refracting with account codes, branch codes, expense centres and project.

– Screen designs can be saved individually for users. This design can be transferred straight to excel. You can transfer all the information from excel to the program as well.

– You can obtain detailed aging reports and settlement forms from the program.

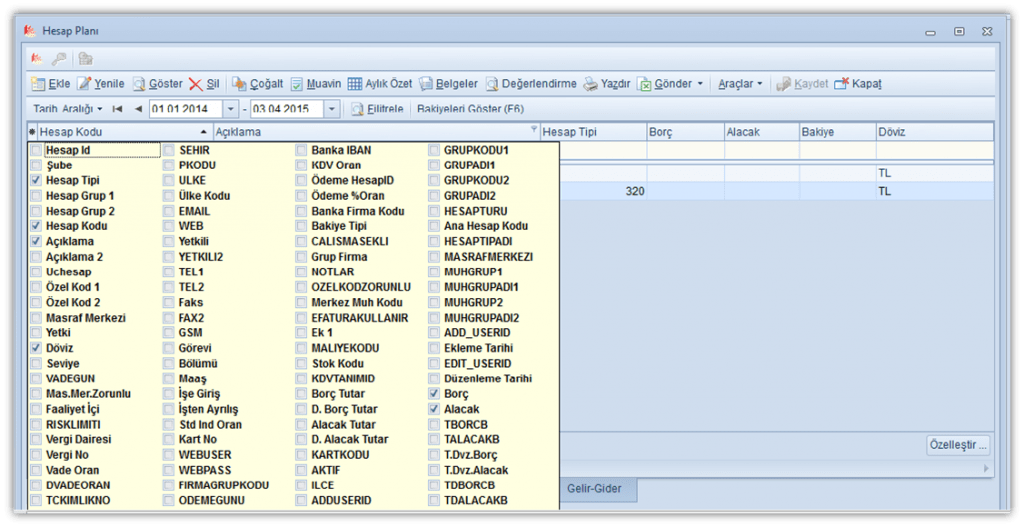

Flexible Structure, Easy Use

– All areas can be viewed or concealed on all lists. Preferred areas can be grouped together.

– All analyses can be accessed easily due to detailed information on invoices.

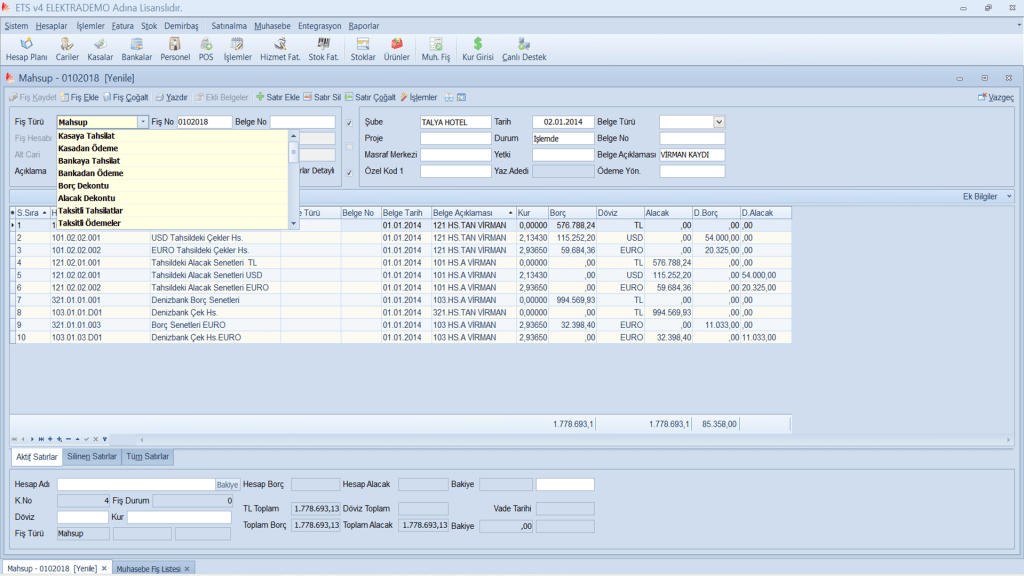

Receipt Input

| – When transactions in other currencies are being done only the TL or currency amount is enough, the system will exchange it automatically. If needed the currency can be interfered with.– The receipt structure supports and automatically fills out document number ,date and type fields suitable with the latest legislation , UFRS an E-book formats and warns the user when it is mandatory.Prevents the user from inputting incomplete or wrong information by guiding them. |

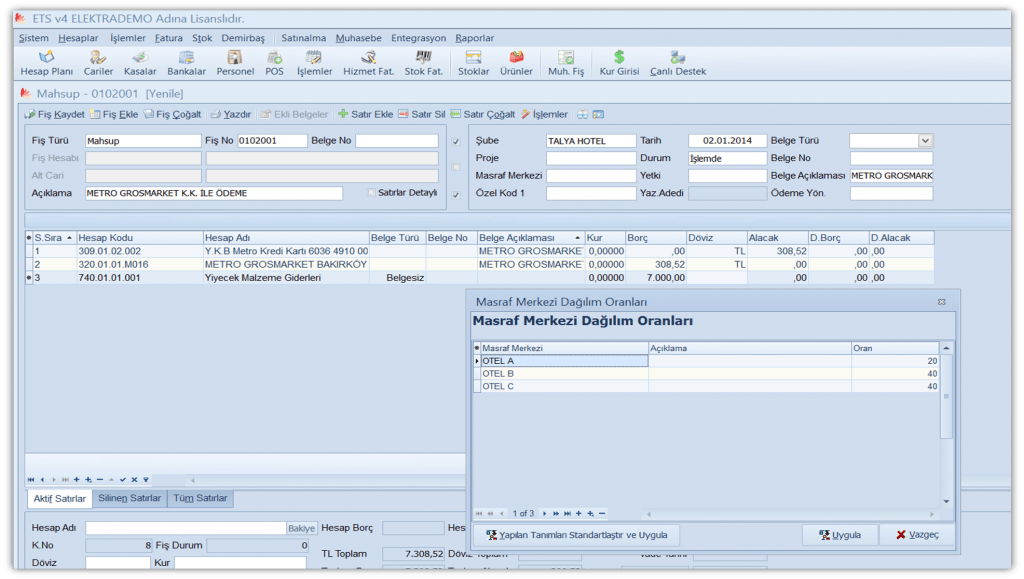

Expense Control at the Receipt Input on an Expense Centre Basis

– Automatic distribution to lines can be done according expense centre keys during receipt input. For instance thanks to this you can automatically distribute an expense lines to an expense centre of your choice.

Lose No Data on ETS

– All deleted receipts or deleted lines on receipts are saved separately and can only be retrieved with the proper authority. In other words no data is deleted physically.

– All receipts can be tagged as «in process» «approved» etc. thanks to the detailed authorisation. Approved receipts cannot be altered by unauthorised people.

Fast and Easy Invoice Input

– While inputting invoices if wanted it can be defined in 8 different categories consisting of expense centres, project codes, 2 special and 2 group codes or the whole invoice as one. All the information is recorded on accounting slips when the invoice is recognised.

– All information and account assistants can be reached easily.

– Data input for invoices with additional tax to be payed such as producer receipts, note of expenses or self-employment invoices can easily be done with the invoice input page.

– Accounting slips belonging to the invoice can be viewed before saving. If requested the accounting slip can be automatically printed while the invoice is being recorded.

Invoice Discounts, Fixed Terms, Payment Options

– Invoice fixed terms are automatically formed according to the chosen checking account. Can be changed manually if needed.

– 2 discount percentage lines on the invoice and a total of 6 underneath including both percentage and amount. True stock expenditure can be calculated according to these discount lines.

– Materials can be received without charge with a freight bill. With the arrival of the invoice the freight bill can be turned into an invoice to make the expense definite. In this event the materials are accepted in with a freight bill. The freight bill’s date will be used as the materials acceptance date.

– Payment belonging to an invoice can be put straight on the invoice. In fact this payment can be made to separate accounts in different amounts.

E- Invoice Compatible

– It is e-invoice compatible. It recognises invoice taxpayer companies automatically and prevents normal invoices from being printed. It sends it online as an e-invoice and records the e-invoice number.

– E-invoice forwarding can be done through the portal or by special integrator. (For additional information about e-invoice please check the e-invoice, e-book, and e-archive modules)

– It is possible to produce e-invoices using the special integrator. (For additional information about e-invoice please check the e-invoice, e-book, and e-archive modules)

– The BaBs report is prepared according to invoice title and tax department areas, thanks to this purchase and sale invoices can be inputted without the need for a valid card. For instance you won’t have to present valid cards for prepaid companies.